Taxfile’s Sue Ashby – Tax & Accounting Help in Devon, Cornwall & Beyond

Sue has been a bookkeeper for 37 years & is also an expert in all areas of VAT. She helps with anything accounting- and tax-related for those in self-employment, in business and working as part of a limited company. She has been part of the Taxfile team since 2016 and, although she’s based in the South West of England, her clients are located all over the UK. Here’s a little bit more about the ways in which she can help clients — perhaps there is something here that she can help you or your business with?

Sue deals with many aspects of accounts and tax, on a day-to-day basis, including:

- For larger clients, for whom she prepares VAT returns, & bookkeeping customers who are further afield, Sue sends out pre-addressed secure mailing sacks every quarter. These get filled by the customer & returned to Sue at the office. It’s easy & hassle-free. Clients can also email data if preferred. Sue works everything to ‘a trial-balance standard’, for complete accuracy and peace of mind, and attends to all the submissions of the returns. She will advise what VAT is due and which HMRC account to pay it into.

- Sue is also in charge of preparing & submitting CIS (Construction Industry Scheme) monthly tax returns & these are carefully reconciled to the net payments in customer bank accounts. It’s important to get employees’ taxes just right each month – and to make sure everyone has been correctly registered.

- Sue can help you register yourself for Self Employment, or your business at HMRC. She can also help you get registered as an Employer with sub-contractors.

- Sue can advise you about rental incomes & the tax-free ‘rent-room-scheme’.

- Sue prepares Profit & Loss accounts for self-employed people’s tax returns & advises people when they need to register for VAT. Personal tax returns are submitted by our team of specialist tax agents, who will ensure you are claiming for everything you’re entitled to.

- Sue can take care of the registration(s) for most types of taxable activities & advise about the type of bank account you will need to run your particular business through.

- Sue also spends a great deal of time troubleshooting problems for people with HMRC — for example, when tax payments have gone into the wrong HMRC account, or when tax payments have gone missing at HMRC. Taxfile is here to help resolve all such issues for customers.

- Sue has many years of experience in dealing with people who are brilliant at what they do, but are less sure of the type of records they must keep & how the accuracy of these may effect their position later on in life.

- Taxfile offers a wide variety of accounting and bookkeeping software & can help you select the best system to run your business. We also tailor our working spreadsheets to our clients’ unique activities.

So whether you are starting out, already up and growing as a business, or are running a Limited Company, we are all here to help and to support you with a wide range of services & skill sets. We also have teams of independent tax & VAT specialists who keep us updated on all the changes & any new rules.

Sue is available for phone consultations from Monday to Friday, between 8am and 8pm. Contact Sue direct on 07702 882 030 or via Taxfile’s main switch-board during office hours (0208 761 8000 — ask for Extension 446).

Sue is based in Taxfile’s South West office, which is 12 minutes from Plymouth City Centre. She is happy to travel to business premises in Devon & south east Cornwall but can also help & supply supporting services wherever you are!

News including New Battersea Taxfile Office

If you live or work in London SW8, check out our new Battersea Office. It’s based in Cloisters Business Centre off Battersea Park Road (the A3205) and is open from 11am to 7pm Monday to Thursday, then from 11am until 3pm, by appointment, on Fridays. The Battersea office is ideally located for all the construction workers who are working on building sites around that South West London area. If they’re sub-contractors, they can benefit from our help in claiming back tax refunds. Rebates are usually due from HMRC due to the overpaid tax usually incurred as part of the Construction Industry Scheme (CIS).

If the construction workers are operating as limited companies, then we can help with anything from director returns and company register to bookkeeping, self-assessment tax returns, confirmation statements, corporation tax handling, capital gains and much more. In a nutshell, if it’s tax- or accountancy-related, we can help!

Check out our latest newsletter for more information about those issues and many more. You can view it online here.

Contact your nearest branch of Taxfile for tax advice and help with all accountancy-related matters:

- BATTERSEA BRANCH (SW8) – Tel: 020 7821 9444 – www.taxfile.london

- TULSE HILL BRANCH (SE21) – Tel: 020 8761 8000 – www.taxfile.co.uk

- DULWICH BRANCH (SE21) – Tel: 020 8761 2268 – www.filetax.co.uk

- WEST COUNTRY BRANCH (Exeter/Plymouth/Poole) – Tel: 01392 875 862 – www.guybridger.com

Guy’s Team

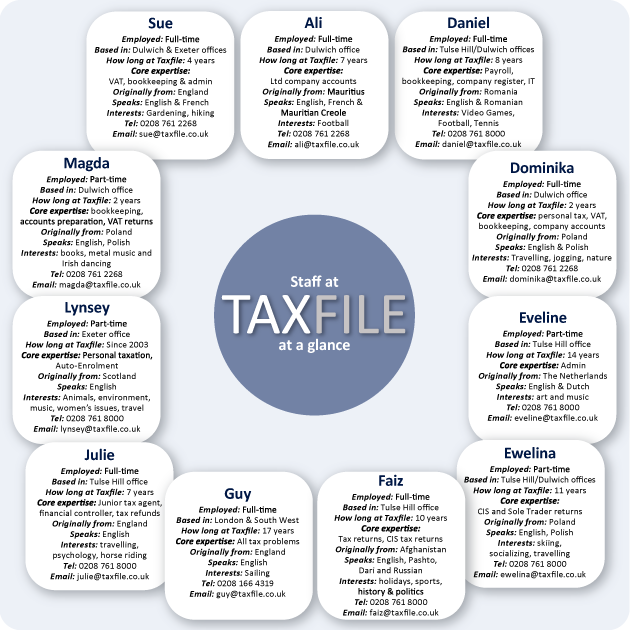

Far from working alone, Guy works with a whole team behind him; from tax return specialists to bookkeepers, payroll gurus, limited company accounting staff and a whole host of other tax experts and support. Our staff ‘mind map’ below tells you a little bit about each of the core team including their main duties and specialisms, languages spoken (you’ll be surprised!), personal interests and, of course, their all-important contact details so that you know whether they’re in the Tulse Hill London office or the Dulwich one, for example. Take a look to see who it is that speaks no less than four languages fluently, which member of staff is into sailing and which one is into both metal music and Irish dancing! We don’t tell you which one below (we don’t want to scare you off), but there is also one team member who is a bit of an expert in martial arts … and as a clue, it’s not one of the boys!

Accountancy Award Finalist!

It’s been quite a while since Guy entered the company into any awards but he was recently encouraged to apply for the 2016 British Accountancy Awards by his local Sage representative. He’s now very glad he did because Taxfile, Guy’s company, is now a Finalist in the ‘Independent Firm of the Year, Greater London‘ category! This is great recognition of the innovation of the company as a whole and the hard work of both the team and Guy himself.

The awards ceremony will take place on 29th November at The Brewery, London (EC1) so fingers crossed for a win! More information on the awards can be found at www.britishaccountancyawards.co.uk.

More details about Taxfile and the accountancy services on offer can be found at www.taxfile.co.uk (for the Tulse Hill office) and www.filetax.co.uk (for the Dulwich office). More information about Guy himself can, of course, be found on this website. Guy tends to specialise in the more complex tax issues that affect individuals and businesses. Guy shares his time between Read more

Sage Accounting Software – FREE!

If you’re a small to medium-sized business* and are one of our customers then this may be of interest to you. Sage One Cashbook the online accounts, cashflow and bookkeeping application, is available free of charge via our Taxfile office in London, so long as you’re one of our customers. There is no other catch – we will genuinely pay your monthly subscription for you if you’re our client!

If you’re a small to medium-sized business* and are one of our customers then this may be of interest to you. Sage One Cashbook the online accounts, cashflow and bookkeeping application, is available free of charge via our Taxfile office in London, so long as you’re one of our customers. There is no other catch – we will genuinely pay your monthly subscription for you if you’re our client!

Why is it free?

Well, together with making your life easier, it’ll help us streamline things at our end because, with your permission, we will also be able to log into your Sage One account to collaborate with you over your income and expenditure records. Also, reconciliation of your bank data is likely to also become quicker and easier. This would not be possible with a desk-top application.

Sage One Cashbooks:

- is easy – no accounting experience is necessary;

- can be set up for you at our end – making it even easier for you to hit the ground running;

- helps you keep your small business* income & expenditure records safely and securely;

- routinely backs up your data in the background; Read more

Tax Avoidance Schemes Too Good To Be True?

HMRC is warning that if a tax avoidance scheme sounds too good to be true, then it probably is! HMRC’s powers to crack down and recoup revenues lost through tax avoidance schemes have grown significantly over the last couple of years, as we’ve reported from time to time over on the Tax Blog. Starting this month, HMRC will begin targeting the 33,000 individuals and 10,000 companies which they believe have been using one or more of the 1200 tax avoidance schemes it identified, following the recent inception of the Finance Act and the resulting ‘Disclosure of Tax Avoidance Scheme‘ (DOTAS) disclosures. Those who have used these questionable schemes are likely to fall foul of the ‘accelerated payment’ requirements which the new Finance Act allows HMRC to demand. With some schemes reportedly dating back to 2004, some are in for a very hefty bill.

HMRC is warning that if a tax avoidance scheme sounds too good to be true, then it probably is! HMRC’s powers to crack down and recoup revenues lost through tax avoidance schemes have grown significantly over the last couple of years, as we’ve reported from time to time over on the Tax Blog. Starting this month, HMRC will begin targeting the 33,000 individuals and 10,000 companies which they believe have been using one or more of the 1200 tax avoidance schemes it identified, following the recent inception of the Finance Act and the resulting ‘Disclosure of Tax Avoidance Scheme‘ (DOTAS) disclosures. Those who have used these questionable schemes are likely to fall foul of the ‘accelerated payment’ requirements which the new Finance Act allows HMRC to demand. With some schemes reportedly dating back to 2004, some are in for a very hefty bill.

In a similar move, anyone who holds funds in an offshore account and fails to declare them to HMRC may soon be officially committing a criminal offence and could face the real prospect of a prison sentence. Under the proposed new plans, financial penalties could be unlimited and Read more

Download Guy’s new brochure

Guy now has a new brochure which covers all the services on offer from offices within the Taxfile group in Exeter and both Tulse Hill and Dulwich in South London. So if you need bookkeeping or an accountant in South London, help with a tax return in and around Tulse Hill and Brixton, or your tax affairs are in a mess in Devon, we have a tax expert for every scenario! The brochure explains it all and includes all the contact details and addresses you’ll need. Also check out the many special offers/discounts available – see the back cover. Click the brochure thumbnail image on the right to download the brochure (PDF format, 1MB).

Guy now has a new brochure which covers all the services on offer from offices within the Taxfile group in Exeter and both Tulse Hill and Dulwich in South London. So if you need bookkeeping or an accountant in South London, help with a tax return in and around Tulse Hill and Brixton, or your tax affairs are in a mess in Devon, we have a tax expert for every scenario! The brochure explains it all and includes all the contact details and addresses you’ll need. Also check out the many special offers/discounts available – see the back cover. Click the brochure thumbnail image on the right to download the brochure (PDF format, 1MB).

Undeclared income: how to get yourself out of a tax nightmare

Last year, Her Majesty’s Revenue & Customs (HMRC) clawed back a mind-boggling £21 billion from would-be tax evaders and avoiders. This represents a steep jump from previous years and sends a strong signal to those who are trying to avoid paying their fair share of tax in the UK. The message is definitely ‘We will find you’ for those who are not playing fair with taxable income. HMRC have even set up a new website, which is being widely advertised at time of writing, aimed at exactly those people. They are not quite offering an amnesty but the site, and links from it, give you the distinct impression that it’s better to voluntarily disclose undeclared income – and even actual tax fraud – than it would be to hide away and wait for them to eventually come knocking on your door, bearing in mind the technological advances and extra staff at their disposal in recent times. In the case of voluntarily admitting to tax fraud, there is even an option of signing what’s known as a CDF contract with HMRC, whereby you make certain promises and take certain actions in exchange for HMRC promising not to criminally prosecute you for the fraud in question. So there is a definite, large incentive to come clean before you are actually caught!

Guy Bridger is in a prime position to help anyone concerned about their tax situation as he specialises in the more messy tax scenarios and can help out in a clear, focused, professional way — after all, he deals with HMRC every single working day on behalf of his many, many private and business clients. Guy can be contacted on 07766 495 871 or email guybridger[at]gmail.com

More awards coming for Guy Bridger?

As many may know, Guy Bridger is the owner of ‘Taxfile’, a tax advice drop-in-shop in Tulse Hill, South London (also now with a branch in Exeter, Devon). To his delight, Guy’s company has been nominated – and is now at the finalist stage – in two categories within the Lambeth Business Awards for 2012.

Taxfile are competing now in the final stages of the ‘Best Small Business’ and ‘Award for Innovation’ categories. Having won the former last year, Guy’s hopes are high!

Guy Bridger and Taxfile are very well thought of in the wider South London business community as they offer inexpensive and professional accountancy services to small businesses including limited companies, partnerships and sole traders. Their services to individuals (e.g. professional tax return help for individuals, retired people, construction workers, taxi cab drivers etc) are also very well-regarded and their particular offering in that sector is pretty much unique (hence the innovation award nomination). A client list topping 2000 including a high proportion of repeat customers is a testimony to their popularity.

Officially the Best Small Business

Taxfile voted Best Small Business in the Lambeth Business Awards.

Guy Bridger and Taxfile are absolutely honoured to have won in the Best Small Business category, and to be recommended for Lambeth’s Favourite Business in the annual Lambeth Business Awards.

Now in their fourth year, the Lambeth Business Awards, in association with MJF Group, have been developed to reward and celebrate Lambeth’s vibrant and dynamic business community. The Awards are a major annual event and a focal point for business networking.

Taxfile proudly donated the Lambeth Business Award prize money of £800, plus an additional £200, to support the immediate response to the serious of disasters which have caused death and destruction throughout Japan and the region through the British Red Cross. In Japan it has been reported that more than 8000 people have been confirmed dead, with over 12000 still missing. Director Guy Bridger said “even if we are a small business our aspiration for a better world and corporate responsibility is not small. We’ve always been very proud of our ties with the community – it’s a great place to live and work and we love it! To be honoured with this award will be a real inspiration for me”.

Welcome

Welcome to GuyBridger.com. Guy Bridger is an accountant and tax adviser who specialises in the more complex tax challenges like HMRC tax inquiries, complicated tax situations for companies and helping people or organisations who have been let down by their previous accountant or whose tax affairs are generally in a mess. Guy is based in Topsham, Exeter, Devon.

For more about Guy, please visit the ‘About Guy‘ page.

Book an appointment!

You can use the interactive Appointments Calendar to book an appointment with Guy or why not visit the News section for up-to-the-minute news relating to tax and accounting for tax in the UK.

We will soon add more content and interesting news to this site. Stay tuned!